|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home After Bankruptcy: Navigating Financial RecoveryEmerging from bankruptcy can be a challenging time, especially when considering refinancing your home. However, with strategic planning and understanding your options, refinancing can be a viable path to financial recovery. Understanding Your Refinancing OptionsBefore you start, it’s crucial to understand the different types of refinancing available. Each option has its own benefits and limitations. Types of Refinancing

When Can You Refinance?The timing of your refinance is crucial. Here’s what you need to know: Post-Bankruptcy Waiting PeriodsAfter declaring bankruptcy, there are mandatory waiting periods before you can refinance:

Improving Your Financial ProfileTo increase the likelihood of refinancing approval, focus on improving your financial profile: Steps to Improve Credit Score

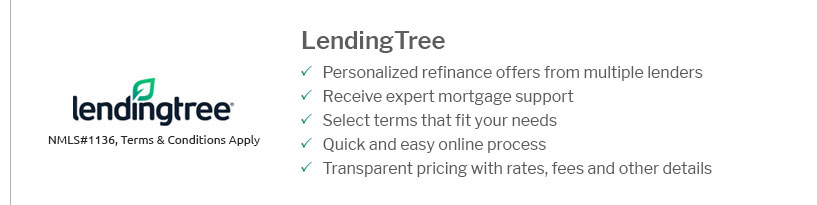

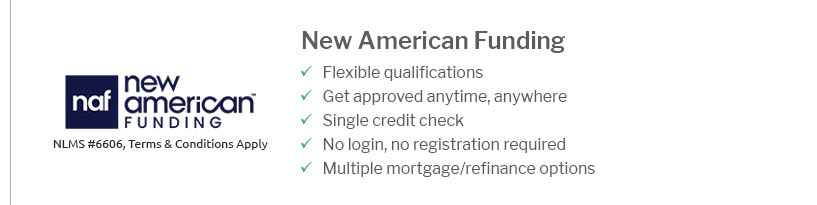

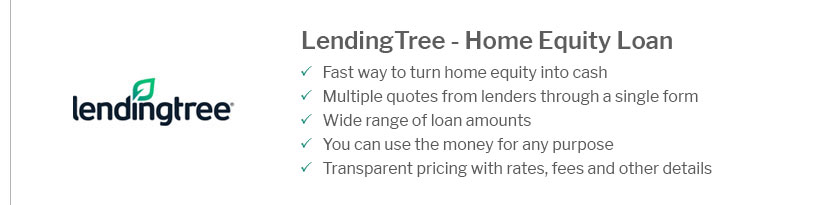

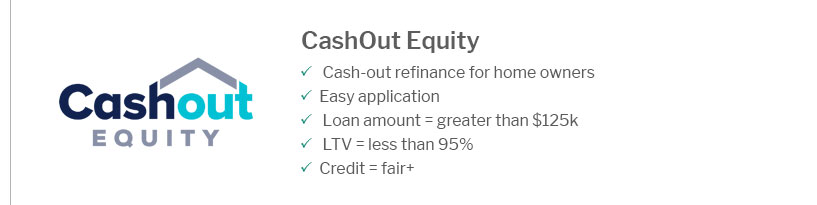

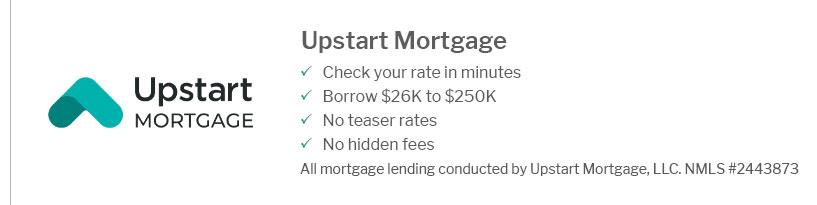

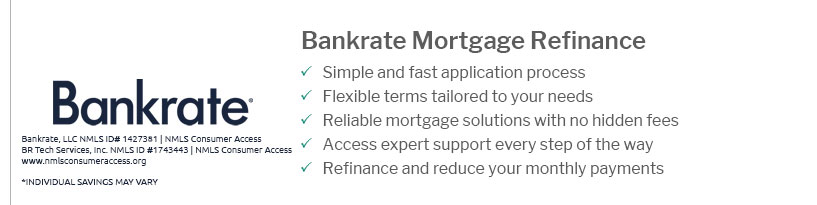

Taking these steps can enhance your creditworthiness, making you a more attractive candidate for refinancing. Choosing the Right LenderSelecting the right lender is key. Consider researching various cash out refinance options to find one that suits your needs. Look for lenders who understand your situation and are willing to work with you. Frequently Asked QuestionsCan I refinance my home immediately after bankruptcy?Generally, you need to wait for a certain period after bankruptcy discharge before refinancing. For Chapter 7, it's typically two years; for Chapter 13, you may qualify after 12 months of consistent payments. What are the benefits of refinancing after bankruptcy?Refinancing can help reduce monthly payments, secure a lower interest rate, or access home equity. It’s a step towards rebuilding credit and achieving financial stability. How can I improve my chances of refinancing approval?Improving your credit score, maintaining a stable income, and reducing debt can enhance your refinancing prospects. Additionally, having a substantial equity in your home can be advantageous. https://lbcmortgage.com/refinancing-bankruptcy-need-know/

You can refinance a bankruptcy-discharged mortgage as long as you have satisfied the waiting periods for the kind of mortgage you are applying ... https://ortizandortiz.com/blog/home-refinance-after-bankruptcy/

Refinancing your home after bankruptcy will be complex and challenging, but not impossible. The first thing will be to know your options. https://www.rocketmortgage.com/learn/how-bankruptcy-affects-mortgages

All major lenders and mortgage investors require that the bankruptcy be either discharged or dismissed before application. Many loan types ...

|

|---|